Your Can i take home loan on my wife name images are available. Can i take home loan on my wife name are a topic that is being searched for and liked by netizens today. You can Find and Download the Can i take home loan on my wife name files here. Download all royalty-free photos and vectors.

If you’re looking for can i take home loan on my wife name images information linked to the can i take home loan on my wife name interest, you have come to the right blog. Our website frequently provides you with suggestions for seeking the highest quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

Can I Take Home Loan On My Wife Name. In case of a gift registration of property in the name of gift receiver is compulsory. Your lender will either decline to add your name due perhaps to credit concerns or agree to add your name by means of a simple mortgage modification. However the owner of the property should always be the primary applicant of the loan. If only your spouses name is on the mortgage you may be able to add your own name to the mortgage.

I Ve Been Married For 4 Wonderful Months As Of Today Actually And I Am Still Working To Get My Name Change Changing Your Last Name After Marriage Dream Wedding From fr.pinterest.com

I Ve Been Married For 4 Wonderful Months As Of Today Actually And I Am Still Working To Get My Name Change Changing Your Last Name After Marriage Dream Wedding From fr.pinterest.com

The interest repayments for this loan should come from a bank account that is solely in Ians name. Here the fact is that the property may have been purchased in wifes name may not mean that the property belongs to her. The land is registered in my wifes name fully we have availed home loan with my wife as borrower and myself as co-borrower. As per this rule i cant claim at all hence i wish to change the proportion of 100 share of my wife to 80 in my name. Using the example above Karen and Ian have a joint loan for a property owned 100 by Ian. Can you please give some ideas in that.

There is one thing you can do to strengthen your position and that is to ensure that repayments come from an account thats solely in the owners name.

Therefore having a joint loan should not create any adverse tax impact. So if you lend her Rs 50 lakh she can later transfer jewellery worth this amount in your name. Therefore having a joint loan should not create any adverse tax impact. However the reverse neednt be true. Speak to an expert Get Started Call us 0808 189 2301. You dont even have to tell your partner youre applying for a loan but its best to be honest with your partner about your finances.

Source: pinterest.com

Source: pinterest.com

Firstly your choice of mortgage lenders and products will be more limited since the majority of mortgage providers prefer married couples to apply in joint names. Speak to an expert Get Started Call us 0808 189 2301. In case of a gift registration of property in the name of gift receiver is compulsory. The interest repayments for this loan should come from a bank account that is solely in Ians name. If only your spouses name is on the mortgage you may be able to add your own name to the mortgage.

Source: pinterest.com

Source: pinterest.com

Here the fact is that the property may have been purchased in wifes name may not mean that the property belongs to her. Using the example above Karen and Ian have a joint loan for a property owned 100 by Ian. The only legal way to take over a joint mortgage is to get your exs name off the home loan. They can then sign a. The person who originally applied for the mortgage could agree to continue making the home loan payments and keep the mortgage loan in their name only.

Source: pinterest.com

Source: pinterest.com

Even a legal divorce does not change the terms of your loan. If you fall behind on payments both you and your ex will face credit problems. When both you and your wifes names are on the mortgage youre both legally obligated to pay the debt regardless of any other circumstances. Is this possible that i can register a 1BHK flat on my name and loan take on my wifes name 6 Responses 329 Views I am planning to purchase a house by taking home loan on my name but I want to register the property in the name of my mother. The only legal way to take over a joint mortgage is to get your exs name off the home loan.

Source: pinterest.com

Source: pinterest.com

However if the entire funding is done from your account only. As per this rule i cant claim at all hence i wish to change the proportion of 100 share of my wife to 80 in my name. However if the entire funding is done from your account only. Now when I ask to keep my wifes name in the Registration Our builder says it is not possible and it should be added in the agreement. As you said 100 ownership is of your wife Loan will also be in the name of wife only so only your wife can claim benefit of repayment of home loan us 24 interest portion for self occupied home and us 80c for repayment of principle amount.

Source: in.pinterest.com

Source: in.pinterest.com

When both you and your wifes names are on the mortgage youre both legally obligated to pay the debt regardless of any other circumstances. If you opt to register the house under your name right now you cant transfergift it to anybody till the time loan is repaid fully. Firstly your choice of mortgage lenders and products will be more limited since the majority of mortgage providers prefer married couples to apply in joint names. Now when I ask to keep my wifes name in the Registration Our builder says it is not possible and it should be added in the agreement. There is one thing you can do to strengthen your position and that is to ensure that repayments come from an account thats solely in the owners name.

Source: pinterest.com

Source: pinterest.com

As you are paying the emi it can be considered either as gift to your wife or Loan. But now i came to know of income tax rules that income tax rebate on home loan be claimed only by the individual on whose name the property is. My house agreement doesnt have my wifes name added. There is no legal requirement for married couples to apply for financial products together. The same goes for a co-borrower who no longer wants to be on the line for a mortgage they co-signed.

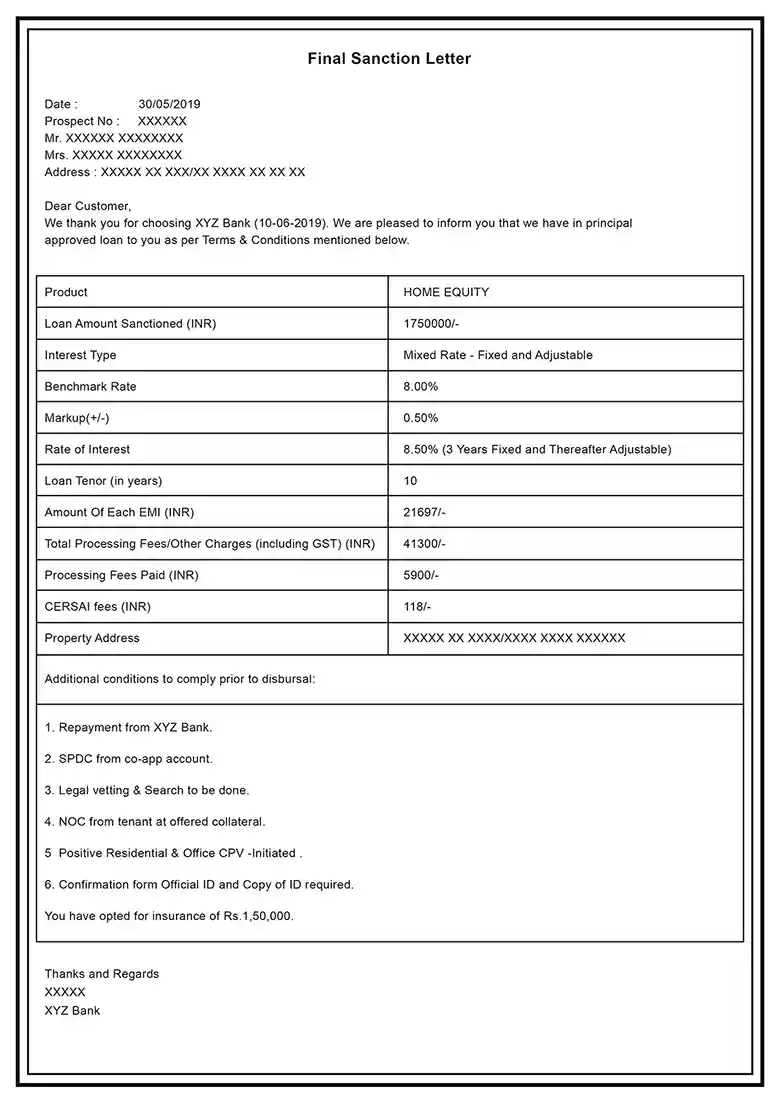

Source: myloancare.in

Source: myloancare.in

However before you decide to buy the next property in your wifes name remember that home loans can also be a deciding factor. One way of circumventing this is to give a loan to your wife. The same goes for a co-borrower who no longer wants to be on the line for a mortgage they co-signed. Therefore having a joint loan should not create any adverse tax impact. But now i came to know of income tax rules that income tax rebate on home loan be claimed only by the individual on whose name the property is.

Source: pinterest.com

Source: pinterest.com

Means Down Payment Property Acquisition charges and total loan repayment than you can claim the entire amount of housing loss in your name considering you are the only owner of the property and your wife do not own any financial stake in the property. The property has been acquired in the name of wife only but source of fund is husbands IncomeWealth. As you are paying the emi it can be considered either as gift to your wife or Loan. There is one thing you can do to strengthen your position and that is to ensure that repayments come from an account thats solely in the owners name. If your ex-spouses name is on the deed and mortgage they legally remain responsible for the mortgage repayment.

Source: pinterest.com

Source: pinterest.com

Speak to an expert Get Started Call us 0808 189 2301. The interest repayments for this loan should come from a bank account that is solely in Ians name. Also the lender has the right to go after your ex if you default on the loan. When both you and your wifes names are on the mortgage youre both legally obligated to pay the debt regardless of any other circumstances. As you are paying the emi it can be considered either as gift to your wife or Loan.

Source: dayjob.com

Source: dayjob.com

November 13 2015 at 654 pm. If you opt to register the house under your name right now you cant transfergift it to anybody till the time loan is repaid fully. However the owner of the property should always be the primary applicant of the loan. Therefore having a joint loan should not create any adverse tax impact. If only your spouses name is on the mortgage you may be able to add your own name to the mortgage.

Source: pinterest.com

Source: pinterest.com

The person who originally applied for the mortgage could agree to continue making the home loan payments and keep the mortgage loan in their name only. Even a legal divorce does not change the terms of your loan. Also the lender has the right to go after your ex if you default on the loan. However if the entire funding is done from your account only. My house agreement doesnt have my wifes name added.

Source: pinterest.com

Source: pinterest.com

However before you decide to buy the next property in your wifes name remember that home loans can also be a deciding factor. Here the fact is that the property may have been purchased in wifes name may not mean that the property belongs to her. Even a legal divorce does not change the terms of your loan. The interest repayments for this loan should come from a bank account that is solely in Ians name. Your lender will either decline to add your name due perhaps to credit concerns or agree to add your name by means of a simple mortgage modification.

Source: pinterest.com

Source: pinterest.com

There is no legal requirement for married couples to apply for financial products together. My house agreement doesnt have my wifes name added. Also the lender has the right to go after your ex if you default on the loan. Your lender will either decline to add your name due perhaps to credit concerns or agree to add your name by means of a simple mortgage modification. The spouse that is not on the note can qualify for a new mortgage loan even though they are on title on a home that is being foreclosed on Case Scenario Where Homeowner On Title But Not On Mortgage This is an actual case scenario where a married couple were able to purchase another home while their current home was under foreclosure.

Source: nl.pinterest.com

Source: nl.pinterest.com

That is co-applicants in a Home Loan need not necessarily be co-owners of the property. There is no legal requirement for married couples to apply for financial products together. Can you please give some ideas in that. My house agreement doesnt have my wifes name added. That is co-applicants in a Home Loan need not necessarily be co-owners of the property.

Source: pinterest.com

Source: pinterest.com

They can then sign a. Also the lender has the right to go after your ex if you default on the loan. The only legal way to take over a joint mortgage is to get your exs name off the home loan. However if the entire funding is done from your account only. They can then sign a.

Source: pinterest.com

Source: pinterest.com

Using the example above Karen and Ian have a joint loan for a property owned 100 by Ian. In case of a gift registration of property in the name of gift receiver is compulsory. The person who originally applied for the mortgage could agree to continue making the home loan payments and keep the mortgage loan in their name only. Speak to an expert Get Started Call us 0808 189 2301. There is no legal requirement for married couples to apply for financial products together.

Source: pinterest.com

Source: pinterest.com

The property has been acquired in the name of wife only but source of fund is husbands IncomeWealth. You dont even have to tell your partner youre applying for a loan but its best to be honest with your partner about your finances. Therefore having a joint loan should not create any adverse tax impact. As per this rule i cant claim at all hence i wish to change the proportion of 100 share of my wife to 80 in my name. Is this possible that i can register a 1BHK flat on my name and loan take on my wifes name 6 Responses 329 Views I am planning to purchase a house by taking home loan on my name but I want to register the property in the name of my mother.

Therefore having a joint loan should not create any adverse tax impact. As we mentioned earlier lenders require all co-owners of a property to be co-applicants of the loan. The spouse that is not on the note can qualify for a new mortgage loan even though they are on title on a home that is being foreclosed on Case Scenario Where Homeowner On Title But Not On Mortgage This is an actual case scenario where a married couple were able to purchase another home while their current home was under foreclosure. Here the fact is that the property may have been purchased in wifes name may not mean that the property belongs to her. However the reverse neednt be true.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can i take home loan on my wife name by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.